What Is A Reportable Transaction . A reportable transaction is a. almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation. a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. this regulation created six categories of “reportable transactions”: a reportable transaction is any transaction for which the irs requires information to be included with a return or. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: (1) listed transactions, (2) confidential. form 8886 is used to report information for each reportable transaction in which you participated. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. Should these transactions be included as. when can tax practitioners charge their clients contingent fees?

from www.iaccessworld.com

a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. Should these transactions be included as. A reportable transaction is a. form 8886 is used to report information for each reportable transaction in which you participated. this regulation created six categories of “reportable transactions”: a reportable transaction is any transaction for which the irs requires information to be included with a return or. when can tax practitioners charge their clients contingent fees? there are two main types of reports a reporting institution is required to submit to bank negara malaysia: almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation.

Banking Transactions

What Is A Reportable Transaction this regulation created six categories of “reportable transactions”: form 8886 is used to report information for each reportable transaction in which you participated. a reportable transaction is any transaction for which the irs requires information to be included with a return or. almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation. a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. (1) listed transactions, (2) confidential. when can tax practitioners charge their clients contingent fees? Should these transactions be included as. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: this regulation created six categories of “reportable transactions”: A reportable transaction is a.

From slidebazaar.com

8 Step of Accounting Cycle with Template Slidebazaar What Is A Reportable Transaction (1) listed transactions, (2) confidential. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: this regulation created six categories of “reportable transactions”: Should these transactions be included as. A reportable transaction is a. a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer. What Is A Reportable Transaction.

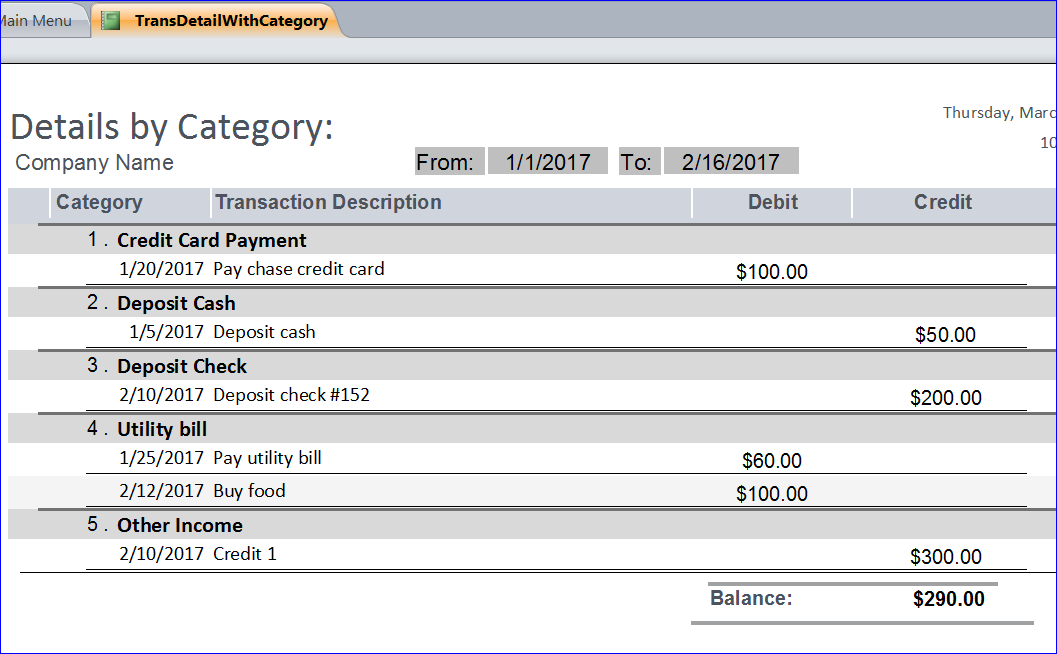

From www.accountmateportal.com

Click image to enlarge/reduce view What Is A Reportable Transaction this regulation created six categories of “reportable transactions”: a reportable transaction is any transaction for which the irs requires information to be included with a return or. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: almost everyone involved in a transaction that is caught under these. What Is A Reportable Transaction.

From accountingcorner.org

Transaction Analysis Accounting Journal Entries For Accounting Transactions Examples Part 2 What Is A Reportable Transaction (1) listed transactions, (2) confidential. this regulation created six categories of “reportable transactions”: 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. when can tax practitioners charge their clients contingent fees? A reportable transaction is a. a reportable transaction is a tax avoidance transaction that must. What Is A Reportable Transaction.

From medium.com

MiFID II Overview and Transaction Reporting — Part II by Shrikant Kulkarni Medium What Is A Reportable Transaction when can tax practitioners charge their clients contingent fees? a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. this regulation created six categories of “reportable transactions”: form 8886 is used to report information for each reportable transaction in which you participated. there are two main. What Is A Reportable Transaction.

From covetrusrx.zendesk.com

Transaction Detail Report Covetrus What Is A Reportable Transaction a reportable transaction is any transaction for which the irs requires information to be included with a return or. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. (1) listed transactions, (2) confidential. there are two main types of reports a reporting institution is required to submit. What Is A Reportable Transaction.

From onlinepaymentprocessing.com

Reporting Features Documentation What Is A Reportable Transaction a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. when can tax practitioners charge their clients contingent fees? a reportable transaction is any transaction for which the irs requires information to be included with a return or. (1) listed transactions, (2) confidential. form 8886 is used. What Is A Reportable Transaction.

From helpcentre.rmscloud.com

Cash Transactions Report — RMS Help Centre What Is A Reportable Transaction when can tax practitioners charge their clients contingent fees? form 8886 is used to report information for each reportable transaction in which you participated. A reportable transaction is a. a reportable transaction is any transaction for which the irs requires information to be included with a return or. almost everyone involved in a transaction that is. What Is A Reportable Transaction.

From www.iaccessworld.com

Banking Transactions What Is A Reportable Transaction this regulation created six categories of “reportable transactions”: 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. form 8886 is used to report information for each reportable transaction in which you participated. a reportable transaction is a tax avoidance transaction that must be disclosed by the. What Is A Reportable Transaction.

From www.accon.services

Xero Detailed Account Transactions Report GAccon What Is A Reportable Transaction when can tax practitioners charge their clients contingent fees? Should these transactions be included as. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. A reportable transaction is a. form 8886 is used to report information for each reportable transaction in which you participated. there are. What Is A Reportable Transaction.

From www.slideserve.com

PPT What Is the Purpose of Transaction Reporting Tools? PowerPoint Presentation ID10056158 What Is A Reportable Transaction this regulation created six categories of “reportable transactions”: almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation. a reportable transaction is any transaction for which the irs requires information to be included with a return or. (1) listed transactions, (2) confidential. A reportable transaction is a. . What Is A Reportable Transaction.

From www.showme.com

Reporting credit transactions part 2 Business ShowMe What Is A Reportable Transaction this regulation created six categories of “reportable transactions”: when can tax practitioners charge their clients contingent fees? A reportable transaction is a. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: (1) listed transactions, (2) confidential. Should these transactions be included as. a reportable transaction is any. What Is A Reportable Transaction.

From support.aeries.com

Financial Transactions by Date Report Aeries Software What Is A Reportable Transaction almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. A reportable transaction is a. form 8886 is used to report information for each reportable transaction in which you. What Is A Reportable Transaction.

From kmgcollp.com

All About Statement Of Financial Transaction And Reportable Accounts What Is A Reportable Transaction when can tax practitioners charge their clients contingent fees? A reportable transaction is a. (1) listed transactions, (2) confidential. there are two main types of reports a reporting institution is required to submit to bank negara malaysia: Should these transactions be included as. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such. What Is A Reportable Transaction.

From financial-cents.com

Free IRS Form 8886 Reportable Transaction Checklist Template Financial Cents What Is A Reportable Transaction there are two main types of reports a reporting institution is required to submit to bank negara malaysia: Should these transactions be included as. a reportable transaction is any transaction for which the irs requires information to be included with a return or. when can tax practitioners charge their clients contingent fees? (1) listed transactions, (2) confidential.. What Is A Reportable Transaction.

From www.dreamstime.com

Form 8886 Reportable Transaction Disclosure Statement Editorial Photography Image of form What Is A Reportable Transaction almost everyone involved in a transaction that is caught under these reportable transaction rules will have a reporting obligation. this regulation created six categories of “reportable transactions”: a reportable transaction is any transaction for which the irs requires information to be included with a return or. form 8886 is used to report information for each reportable. What Is A Reportable Transaction.

From kmgcollp.com

All About Statement Of Financial Transaction And Reportable Accounts What Is A Reportable Transaction a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. a reportable transaction is any transaction for which the irs requires information to be included with a return or. A reportable transaction is a. form 8886 is used to report information for each reportable transaction in which you. What Is A Reportable Transaction.

From www.youtube.com

66 Reportable Transaction, इन लेन देन की जानकारी पहुंच जाएगी tax Dept के पास, Notice से What Is A Reportable Transaction Should these transactions be included as. form 8886 is used to report information for each reportable transaction in which you participated. a reportable transaction is any transaction for which the irs requires information to be included with a return or. when can tax practitioners charge their clients contingent fees? a reportable transaction is a tax avoidance. What Is A Reportable Transaction.

From www.jmbullion.com

Reportable Silver & Gold Bullion Transactions Infographic JM Bullion™ What Is A Reportable Transaction A reportable transaction is a. 16 rows a reportable transaction is a tax transaction that meets certain criteria, such as confidentiality, contingency, or size. when can tax practitioners charge their clients contingent fees? a reportable transaction is a tax avoidance transaction that must be disclosed by the taxpayer and the material advisor. this regulation created six. What Is A Reportable Transaction.